Tax technology: As global economies grow more complex, tax compliance has become one of the most critical—and challenging—responsibilities for businesses. Governments across the Middle East and Europe are rapidly adopting tax technology to ensure real-time monitoring, improve transparency, and increase revenue. In the coming years, this digital transformation will redefine how businesses manage their tax obligations.

At the forefront of this transformation is tax technology—a suite of intelligent digital tools and platforms that automate, manage, and optimize tax functions across jurisdictions. Xibtech Solutions, a trusted IT and software services partner based in the UAE, is uniquely positioned to guide organizations through this shift with advanced, scalable tax technology solutions.

Tax Technology Landscape: Middle East vs. Europe

Middle East:

Countries like Saudi Arabia, UAE, and Egypt have introduced or are in the process of enforcing mandatory e-invoicing and real-time VAT submissions. Governments are deploying integrated platforms to streamline tax filing and enhance anti-fraud measures. Notable implementations include:

- ZATCA (Saudi Arabia): Phase 2 of the e-invoicing program mandates integration with government systems.

- UAE: Moves toward a federal corporate tax regime with digital filing requirements.

- Egypt: Launched a digital tax platform for real-time invoice reporting.

Europe:

European countries are taking significant steps toward Digital Reporting Requirements (DRR) and Continuous Transaction Controls (CTC) to combat tax evasion and boost revenue collection.

- Italy: Pioneer of mandatory e-invoicing.

- France and Poland: Rolling out B2B e-invoicing regulations by 2026.

- Germany and Spain: Planning centralized invoice clearance systems.

Challenges Businesses Face

- Adapting to evolving tax regulations and frequent updates

- Ensuring seamless integration between ERP systems and tax authority portals

- Maintaining cross-border VAT compliance

- Handling data security and traceability

- Managing tax data accuracy across multiple entities and regions

How Xibtech Solutions Can Help

Xibtech Solutions brings deep industry experience in ERP, CRM, custom application development, and tax technology implementation, helping organizations across the Middle East and Europe meet their compliance goals through digital innovation.

Our TaxTech Services:

E-Invoicing Integration

Seamless API integration with platforms like ZATCA, FATOORA, EU e-invoice systems

Real-time invoice generation, submission, and archiving

Custom Tax Portals & Dashboards

User-friendly interfaces for monitoring VAT submissions, payment schedules, and alerts

Automated reporting, audit trail logs, and analytics

Cross-Border Compliance

Multi-country tax configuration and localization support

Support for EU VAT OSS/IOSS, Gulf VAT frameworks

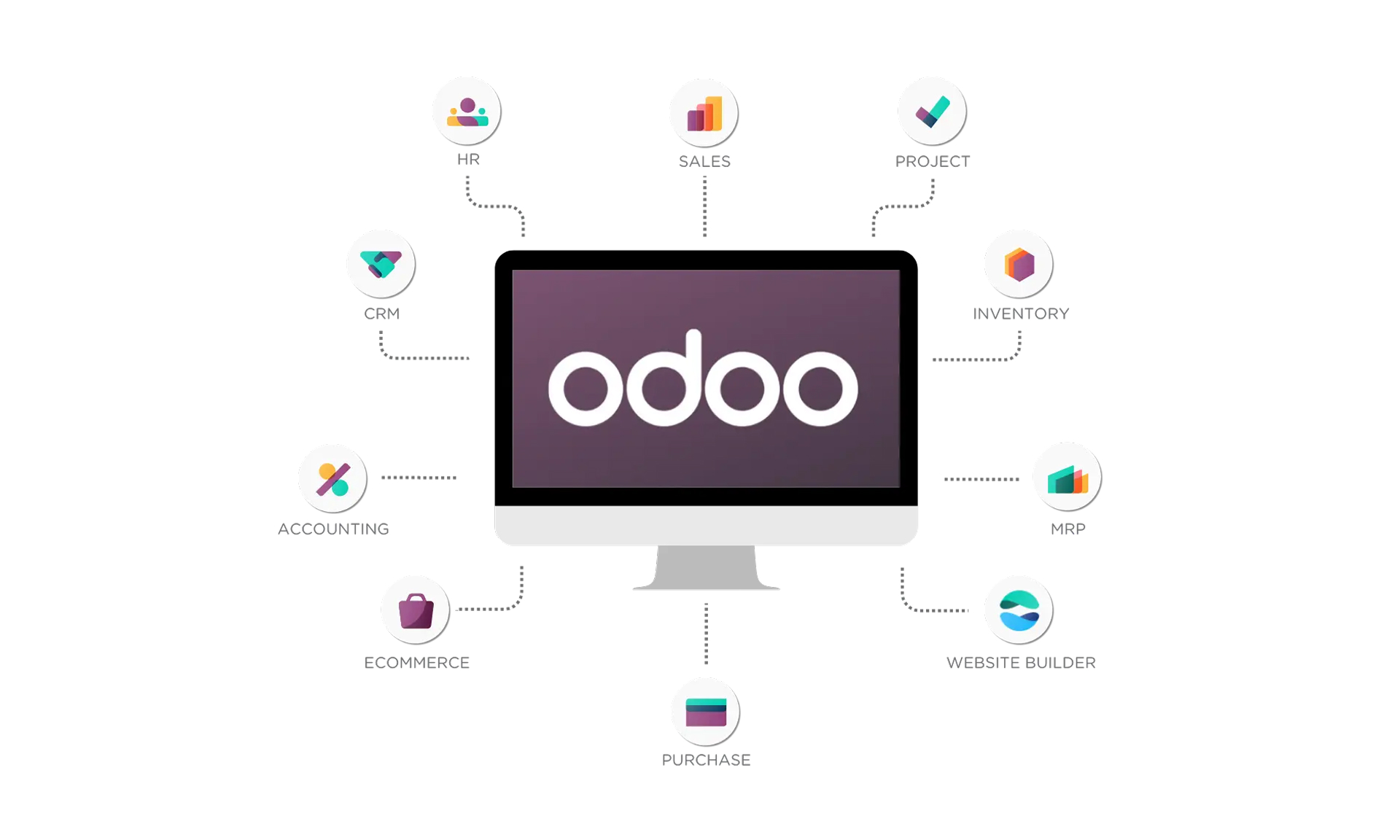

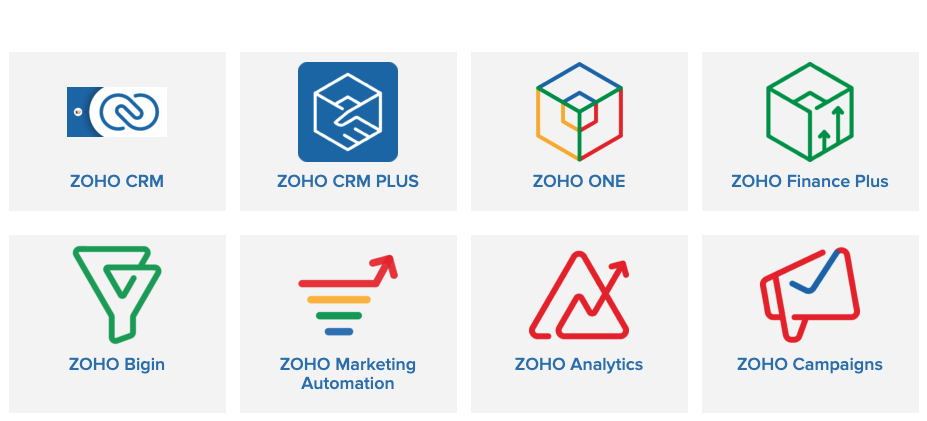

ERP Tax Module Development

Embedded tax rules and real-time validation in ERP platforms like Zoho, Odoo, SAP, and Oracle

Data Privacy & Security

Robust encryption and data governance aligned with GDPR and regional privacy laws

Training & Support

Capacity building for finance teams

Ongoing technical support and compliance updates

Why Choose Xibtech Solutions?

- Regional Expertise: Deep understanding of GCC, EU tax systems and compliance requirements

- Agile Delivery: Rapid prototyping, iterative testing, and quick rollouts

- Customization First: Tailored solutions that fit your business workflow, not the other way around

- Partnership-Driven: We don’t just implement—we advise, guide, and grow with you

Conclusion

The future of tax compliance is digital, automated, and intelligent. Governments in the Middle East and Europe are paving the way with ambitious tax modernization initiatives. Businesses that adapt early will benefit from reduced operational risks, greater accuracy, and improved decision-making.

Xibtech Solutions is your trusted partner in navigating this complex digital transformation journey. Whether you’re a multinational enterprise or a growing regional business, our team ensures that your tax technology investments deliver long-term value and regulatory peace of mind.

Ready to Digitize Your Tax Operations?

📧 Contact us today at contact@xibtechs.com for a free consultation.